For those that are unfamiliar with third-party risk mitigation, the term ‘Software Escrow’ may seem completely alien. On the other hand, those that have an existing understanding of this concept may be very much familiar with Software Escrow and its integral role within business continuity planning.

If you fall under the first category, check out our “Beginner’s Guide to Software Escrow” blog.

In its simplest form, Software Escrow is a legal means of organisations ensuring critical IT assets remain available, even if disruption events impact vendors (e.g., administration, liquidation etc.).

What are Critical IT Assets?

Before delving into Software Escrow, it’s crucial to firstly understand and appreciate the fundamental importance of licensed software and your data in the current business and technology landscape. Most organisations depend upon software applications to operate. Software allows them to deliver goods and services, support employees and meet their legal and regulatory obligations. And the data generated by and housed within applications/servers etc., can be just as important.

Examples of critical applications include CRM Software, Payment Systems, Accounting Systems, Communication Systems, Project Management Systems, ERP Systems, Facilities Management Systems, Transport and Logistics Systems and HR & Payroll Systems.

The magnitude of influence that is held by these applications to ensure that businesses can operate daily is enormous. Therefore, facing interrupted access to these critical applications would be an exceptionally complicated and complex obstacle for a business to tackle.

Software Escrow provides businesses with a safety net ensuring uninterrupted access to critical applications, even in the face of disruption.

How Does a Software Escrow Solution Work?

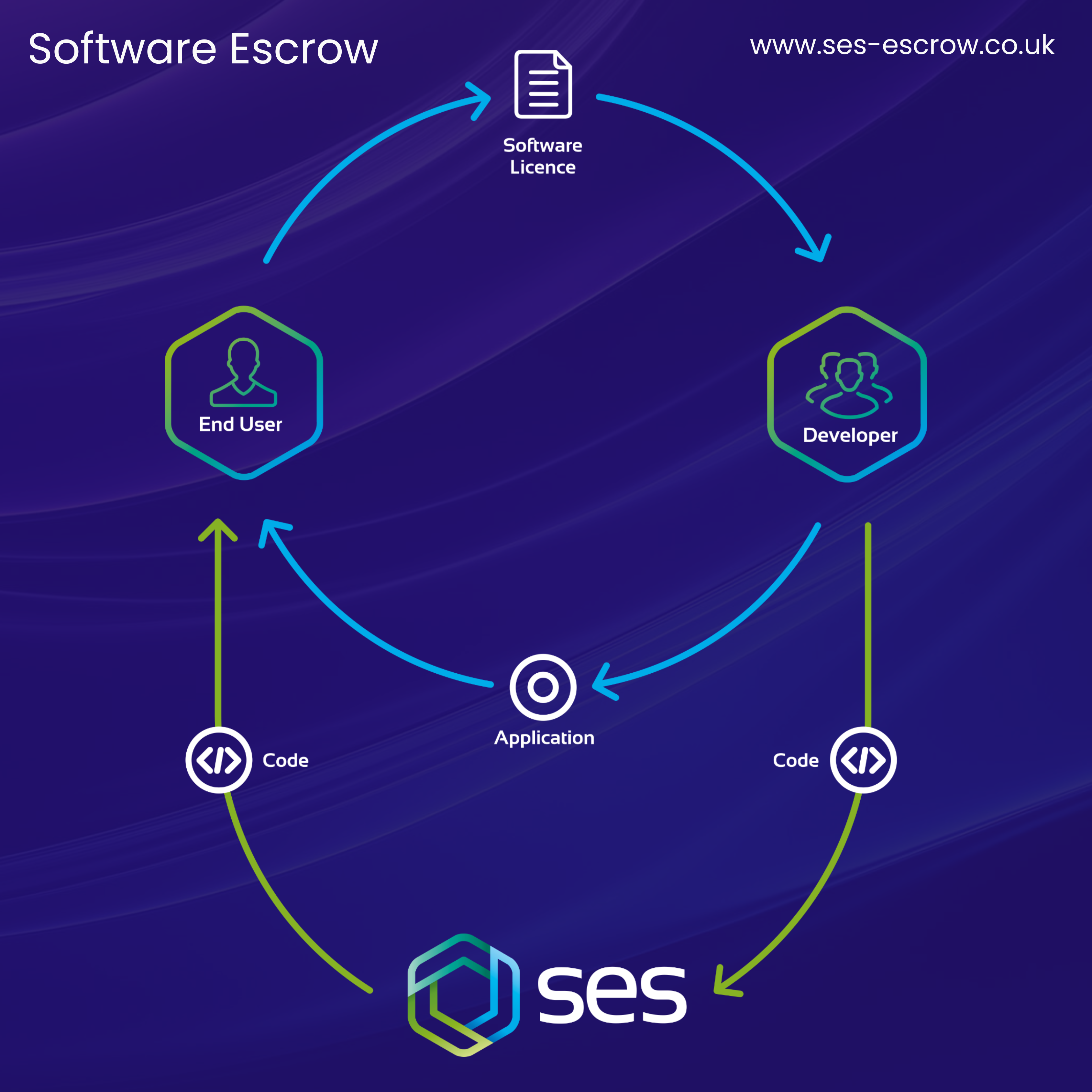

A Software Escrow Solution typically involves a tri-party legal agreement between:

- The end user (the end-user of the application)

- The vendor (the software developer/owner)

- A trusted Escrow agent/provider, such as SES Secure.

The Escrow process:

- An Escrow Solution is proposed based on the needs and specifications of the parties involved.

- An Escrow Agreement is created – this defines the specific release conditions that meet the criteria for a source code release event.

- The licensor deposits source code (source code is the foundation of any computer program) and other materials.

- At SES, the source code is evaluated by our in-house team of technological experts to ensure that it is accurate, up to date, and can be redeployed if required.

- If release conditions are met, the source code is released by SES to enable the end-user to continue with the software and maintain their services and operations.

Software Escrow provides extensive value and benefit to both software vendors and end-users. For businesses (end-users), the solution provides peace of mind in the form of a comprehensive business continuity plan. It also puts assurances in place, ensuring that business operations can continue, regardless of unforeseen situations arising.

For software vendors, the implementation of an Escrow Solution demonstrates their commitment to providing continuous application access to end-users.

Software Escrow Misconception

The most common misconception in the Escrow space is that Escrow providers encourage end-users to doubt the ability of software vendors. This is false and Software Escrow does not encourage end-users to doubt the abilities of software vendors.

At SES, we recognise the immense level of expertise and experience held by software vendors. However, the possibility of unpredicted challenges is a risk that threatens all industries, and even all parts of life.

The implementation of Software Escrow showcases a business’s forward-thinking vision, one that considers and caters to all possible outcomes. Futureproofing is important to a vast range of situations. From the responsibility of team doctors in sports teams to the role of car insurance providers during a road accident, being prepared to manage unexpected circumstances with confidence is undoubtedly a favourable position to be in.

The Rising Recognition of Software Escrow

As technology and the reliance of critical applications continuously rises, so does the level of risk attached.

More and more companies are investing in their business continuity capabilities, with the aim of being as robust as possible.

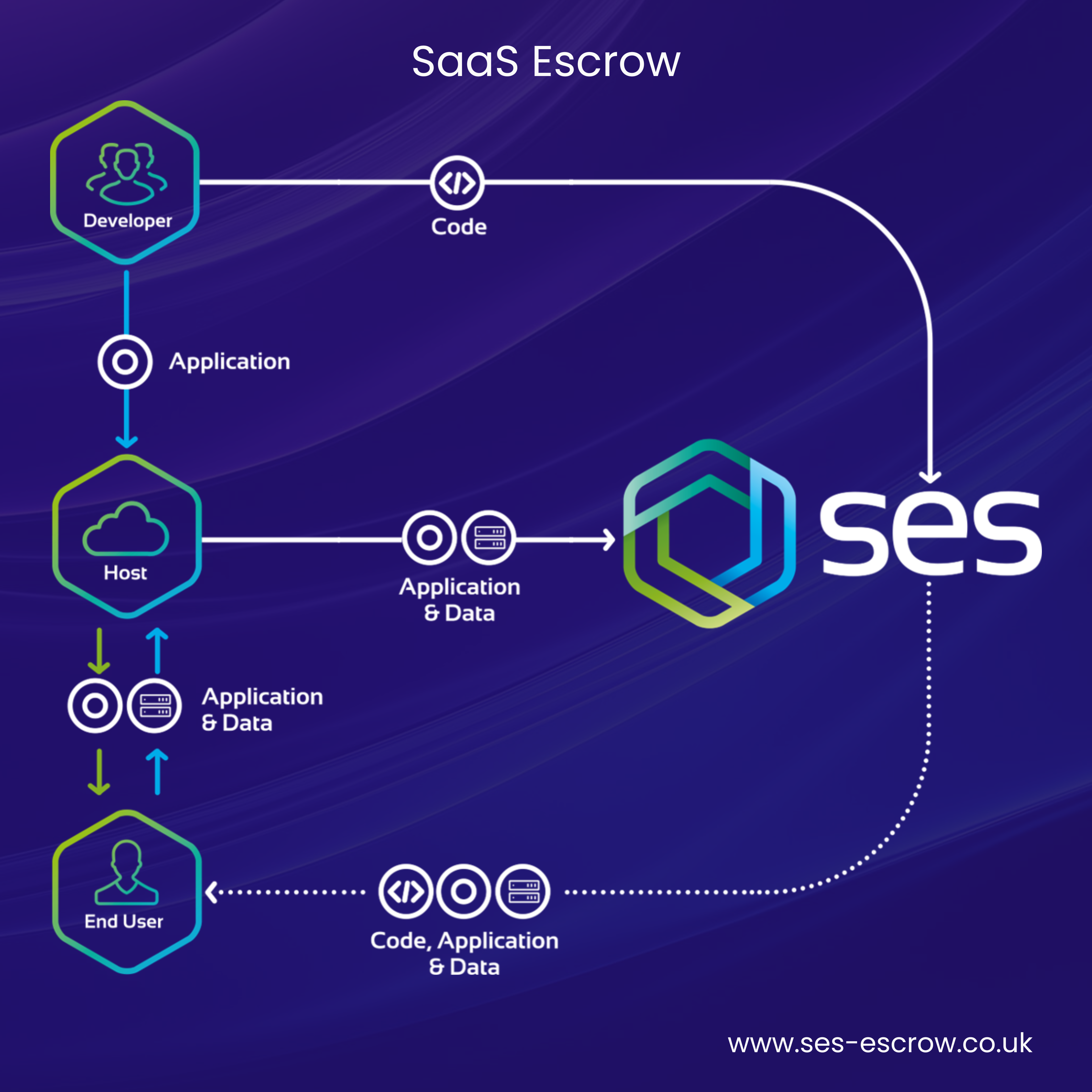

The evolution of Software Escrow means that alongside traditional Escrow Solutions, Escrow can also be used in SaaS systems. This is another common Software Escrow misconception. To learn more about this, check out our podcast with MCR-SEO.

Laws and regulations, such as the Digital Operational Resilience Act (DORA) which will be enforced in the EU Finance Sector in January 2025, are also encouraging organisations to implement Software Escrow to improve their level of Operational Resilience, and in doing so, adhere to DORA’s requirements. This is also a topic that’s discussed in our podcast with MCR-SEO.

SES Secure’s Software Escrow Solutions

For over 25 years, SES Secure have been supporting clients with the implementation of Escrow Solutions. To date, we have over 3,000 clients from across 45 countries.

Our aim is to provide client experiences that place convenience, communication, and client satisfaction at the forefront.

Ultimately, Software Escrow is a fantastic tool for businesses that want to elevate their business continuity, risk mitigation, and operational resilience capabilities. Our vision is to optimise this tool to the best of our ability, and consequently equip our clients with the ability to manage obstacles with confidence and robustness.

Alongside traditional Software Escrow, we also specialise in Software Escrow for SaaS (Cloud-Hosted) applications.

Interested in speaking to a member of our team? Our team of experts are always at hand to answer questions and provide guidance. Please don’t hesitate to get in touch or give us a call on 0161 488 1400.